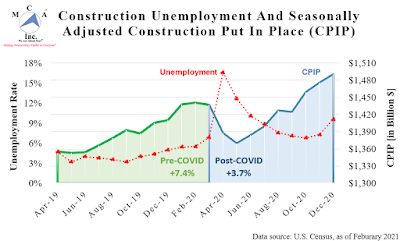

Five Steps to Take Control of your Project

As construction projects ramp up and get moving, things change fast and furious, issues accumulate, and things might not go as smooth as expected. As the General Contractor (GC) starts to shift the project schedule, areas you are scheduled to work in are not ready, trade interference is forcing your crew to either work on top of another trade or to come back to the same location multiple times, or other holdups that result in being moved around on-site and not being able to complete your work as scheduled. The common nature of these issues is that they will put you in the passenger seat only reacting to what is coming at you rather than being in control. However, there are five simple steps to take control of your project.

Data from Short Interval Scheduling (SIS®)on daily work obstacles collected by foremen and electricians onsite shows that approx. 40 – 50% of the reported hours that a crew wasn’t able to perform the work as scheduled revolves around the GC schedule. If not managed appropriately, there is a high risk that any trade contractors will be left with the impacts and the additional direct and indirect cost. To not be the victim to this, the question to address is how you and your company manage schedule changes and track obstacles on job sites. You have to have clear responsibilities, a transparent process, and well-defined procedures in place to manage these issues, and don’t leave it up to the foreman and the crew on site to just make it work?

Contractors should think about creating an internal scheduling process or get support from project scheduling experts who will assist with the responsivities, process, and procedures. Taking control requires an effective scheduling process for your construction project. This process follows a clear set of steps that starts with the GC schedule, and includes additional actions and tools that help you to track, measure, document, respond, and overall manage the schedule impact construction projects. The Work Environment Management (WEM®) concept shown in Figure 1 below illustrates the structure, steps, and tools needed. Gathering job-site intelligence on a regular and frequent basis plays an integral part in taking control of your project, and particularly for the documentation and quantification of the impacts.

|

| Figure 1 – Work Environment Management (WEM®) Concept |

Contractors should clarify the following when creating a scheduling process:

- Who is responsible for knowing about the contractual details and requirements?

- Who knows how much time you have to react and respond?

- Who knows if you can send a letter stating that you reserve the right to respond within the next few weeks?

- Who knows how to quantify and document the impacts?

- Who manages the process to communicate and report back the impacts from the schedule issue to the GC?

Once these responsibilities are clear, the following five simple steps derived from the WEM® Concept (Figure 1) will help contractors take control and be ahead of managing their projects.

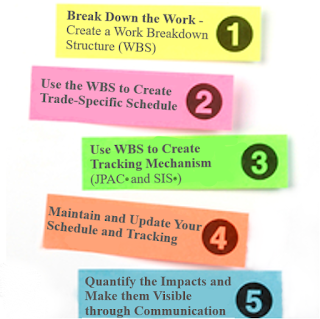

#1 Break Down the Work, Create a Work Breakdown Structure (WBS)

A Work Breakdown Structure (WBS) is a simple way that can help you “See the Work” and provide a structured way to identify the work to complete for the project. A WBS shows the deliverables and all work to be performed broken down into manageable chunks based on the schedule of values, drawings, specs, and contractual obligations. Have a foreman break down the work using the information and knowledge about the project, such as plans, specs, drawings, schedule of value, bill of material, and BIM model (if there is one). Project requirements and information might not always be complete, but don’t wait! Start with the breakdown into high-level deliverables, refine and break them down into the actual work as the missing information becomes available. A good start is the four main project phases of Planning, Procurement, Installation, and Closeout (see Figure 2).

If you want to become an expert at WBS and other Agile Construction® Principles join an Agile Construction® 101 Webinar and take also a look at MCA’s publications on Work Breakdown Structure (WBS):

- Agile Construction® (2nd Edition)

- Work Breakdown Structure from the Field

- How to Manage Your Job Using Work Breakdown Structure.

#2 Use WBS to Create Trade-Specific Schedule

Connect the WBS with the GC Schedule (if one is available) and translate your WBS into your trade-specific schedule by adding start and end dates. Begin to structure and schedule the work in your WBS based on the GC’s schedule and identify “What Work to Perform Where, When, and by Whom” using project management software or with the support of a planning and scheduling expert. Next, create a rolling three-week lookahead from your project schedule each week, which will show the areas and work available for the particular crew to complete.

#3 Use WBS to Create Tracking Mechanism (i.e., JPAC® and SIS®)

Data and information as direct feedback from the field are essential to understand what obstacles the crews run into day in and day-out and how productivity trends and is affected. First, use the three-week lookahead, and have the foreman and field crew do daily task schedules using software tools, such as Short Interval Scheduling (SIS®), that allows reporting, tracking, and documenting any task-specific obstacles on-site along with their impacts, if a scheduled task couldn’t be completed. Second, use the WBS to track labor productivity using an existing software application or via Job Productivity Assurance and Control (JPAC®), which is based on ASTM E2691 Standard Practice for Job Productivity Measurement.

#4 Maintain and Update Your Schedule and Tracking

Maintenance and continuous updating of your schedule with information from multiple sources are important to get a realistic and most current picture of the outstanding work, effort, and time needed for the project.

- Include all changes to the project scope that impact the effort and work to complete the project, such as change orders, revisions, or rework caused by other trades.

- Capture and track all updates and changes to the original GC schedule that affect the time and duration of the project, such as schedule sequence, delays, or compressions.

- Use the information from the field and the data on labor productivity and work-based %-complete (through JPAC®) together with the feedback from daily scheduling and jobsite obstacle reporting (through SIS®).

#5 Quantify the Impact of Changes and Make them Visible through Communication

Typically, there is not an unlimited amount of time to react, quantify and inform the GC about the impact of schedule-related issues. First, make sure to respond to the GC by the given deadline. It is good practice to send the GC with an acknowledgment letter within the deadline stating that you reserve the right to respond in full until a reasonable deadline (typically within a few weeks). Quantification of schedule issues, such as schedule compressions, schedule changes, or schedule delays caused by trade interference, area not ready, or the recently mandatory health and safety measures for COVID-19, can be time-consuming and complex. Keep in mind that all of these issues do not only affect the direct labor cost on the project but have rather broader implications also impacting indirect costs, such as overhead, insurance payments, etc., which can easily be overlooked. All impacts need to be assessed, quantified, and communicated on time to the GC in an impact letter and supporting documentation from the collected job site intelligence to preserve the right and opportunity for compensation.

Identification and Mitigation of Job Risk

Construction is a risky business that involves risk management on several different fronts - from safety to litigation, to business/financial.

Current Risk Statistics

Approximately 13 million hours are lost due to non-fatal injuries and illnesses in the construction industry every year. Electrical construction makes up approx. 9% of the total hours and approx. 45% of all non-fatal injuries and illnesses in Building Construction (see Agile Construction® For the Electrical Contractor, 2nd Edition for a full study of safety risks and impacts by sector between 1992 and 2018).

Along with safety risks, the construction industry tops the lists for insolvency and litigation, often because of an inability to manage costs, avoid overage on project budgets and schedules. The construction industry is often near the top of insolvency lists, and according to the Global Euler Hermes analysis, for the first three quarters of 2018, construction was the industry with the most major insolvencies, approx. 5% higher than the second-worst sector, and 70% higher than the third.

In 2019, dispute values, durations, and volume all increased over the past year in North America. The value of disputes rose to $18.8 million. The average time taken to resolve construction disputes for North America increased from 15.2 months in 2018 to 17.6 months in 2019 (Arcadis, 2020). It was also determined in a 2016 McKinsey analysis, that construction projects typically take 20% longer to finish than scheduled and are up to 80% over budget. Also, the construction industry has one of the highest exposures to daily risk and mitigating those risks related to COVID-19. Without a doubt, risk mitigation must be a priority before, during, and after a project. The constant shifting of priorities on the job site, along with other factors such as safety concerns, schedule delays, and contract disagreements, create a fluid, dynamic, and often risky situation.

1. Understand the Risks

To be able to mitigate these risks, it is important to understand that the different types of risk should be evaluated throughout the life of the job. Mitigation of risk in any event - at the job, local, regional, national, or international level- has three layers of cadence, which need to be planned for and managed (according to a draft standard for ASTM):

- Business Risk – the probability of a difference between the expected and actual financial outcomes of a project.

- Technical Risk – the probability of a physical failure of the built environment to function according to customer requirements or structural requirements.

- Integration Risk – the probability of failure at the interface of resources required to complete the project, including manpower, material, money, and information.

While the business and technical risks are more widely understood, it’s the integration risk that often gets overlooked or not paid much attention to.

|

Figure 1: The Essence of

Project Management |

2. Identify the Risks

For each of these three risk categories, line out how much you know about this risk (Known), what is unknown to you at the moment (Obscure), and what is unknown but not predictable whether or not it happens (Uncontrollable) as shown in Figure 1.

- Known items can be gathered for specs, drawings, bid information, contract, etc.

- Obscure items are those that you don’t know in detail, but you are aware of. You know that you are missing information that you can get (“you know that you don’t know”), such as an upcoming change order that you have heard of, or detailed instructions for the installation of the fixtures. These items can particularly become a risk if not managed and it is worked on getting the missing information completely on time.

- Uncontrollable items are events or issues that are not known and are unlikely to be predictable. If these things occur, they will likely blind-side us and therefore carry and drive a significant amount of risk.

3. Reduce and Manage the Risks

- Be aware of the three different types of risk: For each of the three types of risk outlined above, list all known items, obscure items, and uncontrollable items, as described above.

- Create your Risk Mitigation Plan for each type of risk:

- Business Risks vary from job to job and it depends on how your business is set up strategically. The EMR (Experience Modification Rate), also called MOD rating or factor, is one of the factors a business needs to consider, especially on risky jobs. To ensure the business will not be impacted by higher MOD rates, the connection between Safety and Productivity needs to be understood.

- Technical Risk can be reduced by in-depth investigation and understanding of all involved people for this task, which can be difficult and not always able to cover 100%. To almost eliminate or at least reduce the technical (and integration) risk, the Operational Model for Modular Construction needs to be considered.

- Integration Risk constitutes most of the time the biggest risk on a construction project. To manage this risk, ensure structured information exchange and initial planning meetings for each job. You can find more details on the Five Keys to a Successful Project Handoff and Startup. Further, identify and make the work visible using a Work Breakdown Structure (WBS) before the work is started on site. It is essential to understand how to create an effective WBS from the Field and How to Manage your job using WBS.

Keep in mind that this is a process and journey to get there, which might require some time. Remember, just identifying the risks once, maybe at the beginning of the project, is not the full story. The reviews recommended in Step 2 need to be done on a regular and frequent basis throughout the project.

For further reading and other resources on Risk Management:

- Planning for Safety:

- “Safety and Productivity: The Effects of Visibility and Planning on Safety Risk”, Insights Magazine (2018)

- “Planning for a Safe Working Environment”, Insights Magazine (2017)

- Methods for setting up and laying out a contracting business:

- Creating an operational model to reduce risk in the modular construction environment:

- Managing risks during the pandemic:

Research Corner

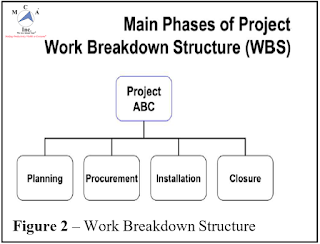

Update: U.S. Construction Market Trends and Shifts pre and post COVID Outbreak

For about nine months we have been waiting and looking forward to it… No, not the birth of your newborn. Congratulations though if you have become parents! It has been more than nine months now since the outbreak of COVID-19, and we are referring to the end of the year 2020. We were all waiting for 2021 to come and to leave such an unprecedented, chaotic, and potentially tiring year 2020 behind. The impact of 2020 will leave its impressions and long-lasting marks on economies, societies, and technology around the world.

Due to the high interest in our last article in the Q3 2020 SOTI on “U.S. Construction Market Trends and Shifts pre and post COVID Outbreak”, we want to pick up the topic again and share more market insights and provide an update to the trends and developments of the U.S. construction market and industry.

|

| Figure 1: Value of Construction Put in Place (Annual Seasonally Adjusted Rate)and Unemployment Rate |

Figure 1 illustrates the current updated development and trends of the seasonally-adjusted annual value of construction put in place (CPIP) as well as the unemployment rate in the construction industry between April 2019 until November 2020. After a strong and steep dive in construction spending during the first three months after the COVID outbreak in March 2020, the industry continues on its path of slow but steady recovery. By the end of 2020, seasonally-adjusted total CPIP exceed pre-COVID values by about +3.7%. With the improvement in the overall construction market environment, unemployment rates (see Figure 1) dropped after spiking to 16.6% in April 2020, shortly after the outbreak of the pandemic. At the end of Q4 of 2020, unemployment in the construction industry leveled at around 7%, before seeing a slight seasonal-driven increase to about 9.6% in December 2020, according to data from the U.S. Bureau of Labor Statistics. This is overall good news but doesn’t tell the full story. The data further illustrates that there are major differences in impact and trends across the three main market segments, i.e., the Residential, Commercial, and Industrial Market Segment, and the (see Figure 2).

|

| Figure 2: Breakdown of Construction Spending (CPIP) |

Post-COVID, total residential CPIP in the U.S. grew by +17.5%, while total non-residential construction (commercial and industrial) shows negative growth of -6.0%. While both public and private construction spending dropped immediately following the COVID-19 outbreak in March, both sectors show a very different development. As of December 2020, the total private construction is up by +5.7% relative to Pre-COVID highs in March 2020, which is strongly driven by a major jump in private residential spending (+17.5%) over the past five months and continuing to be fueled by historically-low interest rates. At the end of 2020, CPIP for private residential has grown by +17.5% since the outbreak, which is in particular remarkable as the market segment took a major hit and dropping by -8.2% from March until May 2020. Data show that private construction spending in the non-residential segments (industrial and commercial), however, is down -6.0% and continues to trend downward as vacancies in project backlog cuts, deferrals, or entire cancellation of projects and investments early after the outbreak in these market segments become visible.

During the first three months of the pandemic, government and public authorities’ advanced spending in public health care, public safety, as well as water supply and sewage/waste disposal infrastructure. Although public construction is still -2.1% behind pre-COVID levels, positive trends in the largest public construction market categories (highway and street, education, and transportation) at the end of Q3 and the beginning of Q4 of 2020 contributed to a slight recovery in total public construction overall.

What does this mean for you and how does it impact your business?

Over the past two decades, the composition of the national construction market has continued to shift away from the industrial market segment, experiencing a significant increase in the money spent on commercial and residential construction projects. While this national trend is also observed in most states, the extend of this shift and the fraction of overall dollars spent by owners of construction projects in each of the three market segments varies significantly across states (see Figures 3 and 4). As the extent and timing of restrictions and measures put in place for social distancing are state-specific the market impact of this pandemic is likely very different for contractors depending on their geographic location across the U.S., and the proximity of highly affected metropolitan areas. MCA has developed a well-established economic and customer-centric market study methodology that allows the investigation of local markets on a state, MSA, county, or even local union level. This granularity of market analysis will provide unique insights into the details of your trade-specific local market, its total size, its segmentation, a breakdown of the main industrial, commercial, and residential market segments into more than 30 different detailed market categories within your geographical area. An analysis of trends and the labor composite rates required to compete in more than 30 different detailed market categories have helped several NECA Chapters, IBEW Local Unions, as well as individual union and non-union contractors across the U.S. to identify the most promising market opportunities and new market trends to position themselves ahead of industry competitors. Contact MCA, Inc. for more information about how a market study will help fill your needs in understanding the implications of this pandemic for your local market, which has initiated and accelerated so much change, innovation, and disruption in the construction industry over the past nine months.

Research Projects

New Research Project: “What’s Next After Prefab?”

We are happy to announce that ELECTRI International has commissioned MCA, Inc. to conduct a focus group research project in 2021 on “What’s next after Prefab? Establishing and Standardizing Quality Control for Prefabrication”.The goal of this research is to provide electrical contractors with a current look at the implementation of Prefabrication in the industry, the potential for expansion, the barriers to expansion, and develop guidance for establishing internal standards and quality controls to achieve these increased expectations. The aim is to look at the integration of published NEIS Prefabrication Standards to explore ways of increasing the use and benefit of prefabrication in electrical contracting by establishing practices that include setting goals for measurable improvement in quality, safety, and overall consistency as we expand the use of prefab.

Industrialization of Construction®: Signal or Noise? Threat or Promise?

The research project “Industrialization of Construction®: Signal or Noise? Threat or Promise?” came to completion during the last quarter of 2020. This research investigated how Industrialization will continue to unfold in construction and provided ELECTRI and its members a means of getting and staying ahead. During the research, MCA, Inc. developed a guidebook and two self-assessments for contractors to use to move the needle forward in their company and worked with three electrical contractors to test the applications, collect their results, learning and feedback.The applications developed as an outcome of the research are currently available to complete online at MCA’s website, and are listed below:

- The Industrialization Index Self Evaluation is a 15-question self-evaluation in which you assess how often different practices, measurements, or models are applied within your group and/or across your projects.

- The Industrialization Index Litmus Test is 16 multiple-choice questions asking you to mark the function primarily responsible for decision-making regarding different elements of the job (material, labor, tools and equipment, sub-contractors).

Estimating with and Pricing of Prefabrication

Contractors need a practical way to track and quantify the benefits of prefab. Business owners, estimators, and project managers need both confidence and knowledge about the cost-saving potentials of prefab so they can account for prefabrication when bidding potential work. ELECTRI International commissioned MCA Inc. to conduct a deep-dive study of pre-fab to help the EC industry focus on risk mitigation, higher predictability of cost, quality of work, and profits. In addition to specific recommendations, an Excel-based Prefabrication Calculator was developed to help contractors translate the total savings from Externalizing Work® into an equivalent composite rate as a practical method for “pricing” estimates with prefab.- Research Video: Link

- Get the Research Report: Click here.

- Contact us if you are interested in the research project or in MCA’s prefab assessment and implementation services.

Publications

Recently published articles:

What is in the press? Here is a sneak preview of the topics of our upcoming articles to be released in the June SOTI Report:

- Taking Care of Business

- Invisible Decisions

- Cost of Minor Distractions

- Pitfalls of Owner-Supplied Material

- What Business is the Contractor in? Logistics or building?

- Construction Technology and the Silver Bullet Syndrome

- Measuring and Improving Underbilling

Other publications you might also be interested in:

- Agile Construction® Books:

We are excited to announce that our team is working on a new addition to the series of MCA’s Agile Construction® Books.

The new book titled “Agile Methods for Continual Improvement” build on the Agile Construction® Principles and provide insights into the required supporting structure for Agile Companies and guide through the fundamentals and How-To’s of process design and process improvements.

- Industrialization of Construction® Books

Outreach Corner

MCA wrapped up 2020 with a record number of classes and participants being taught. One of those successful webinars that we offered at the end of the year was for ECA – Electrical Contractors Association – City of Chicago. The class taught fundamentals of process design, to help managers or potential managers learn how to map flowchart, and design or redesign processes and supporting procedures. Specific flowcharting technique was covered, including how to create them, read and analyze them, and use them to design or improve process outcomes.

As we start the new year we pick up where we left off and continue to expand our online workshops & seminar offerings. All courses and workshops can be found on the MCA-soft.com website’s Course Catalog. MCA looks to offer several courses due to the high demand with Agile Construction® 201 & 301 courses that dive deeper into the topics and strengthens the practices we teach.

If you are interested in an interactive classroom setting that discusses the industry topics, trends, and practices that affect your bottom line then check out our upcoming events:

- March 11, 2021 - Agile Construction® 101 – Online Workshop

- March 18 &19, 2021 - Material Procurement & Movement in Agile Construction® 101

- April 8, 2021 - Agile Construction® 101 – Online Workshop

- April 22, 2021 - Agile Construction® 201 – Online Workshop

Visit our website to see our future Workshops and Seminars

MCA Symposium 2021 – Data-Driven Installation

When the construction industry's leaders and experts meet this year, don't be on the outside looking in. Secure your opportunity to join the conversation as we tackle the issues that affect your bottom line and provide guidance and insight for navigating topics like:

- Effective communication with General Contractors & getting change orders paid

- Leveraging existing and new technology to your advantage

- Improving project management approach (PM 2.0) to tackle labor workforce shortage, increase job profitability, scheduling, procurement etc. using the industry accepted and recognized ASTM E2691Standard Practice for Job Productivity Measurement

- Improved communication for change orders

- Save 10-40% on labor cost and Increase job profits by leveraging existing vendor relationships & creating effective partnerships through Agile Procurement®

If you are interested in our next 2021 Spring/Summer Symposium on Data-Driven Installation Phase, make sure to reserve your spot and sign up here: MCA Symposium.

Customer Corner

MCA, Inc is thrilled to announce its agreement with Work Environment Management, LLC

Work Environment Management (WEM), LLC is a female majority-owned business that is authorized to promote and distribute MCA, Inc’s Agile Construction® Software to expand its reach and have packages for businesses of every shape and size. WEM, LLC customers can use the Buy-Track-SaveTM model and see results quickly. Buy JPAC® and SIS®, Track your productivity and be on your way to Save. WEM, LLC has a proprietary onboarding that is unique for software sales. They are with you every step of the way on launching the software, and therefore savings, for your company. Then when you’re ready, WEM, LLC can also provide scheduling services to help with your business transition and support your communication with your GCs/customers. For more information, please contact info@wemsoftware.com.

WEM LLC. is excited to provide an update on the progress of some of our clients with representation on the East Coast, West Coast, and the South!

- “Things at In-West Electric have been good as we had our most profitable year ever thanks to you guys. We almost doubled our gross profit margin this past year. Your systems work well!” - (Mike Wallis, Owner of In-West Electric, Inc., February 2021)

Frischhertz Electric out of New Orleans has begun their journey toward Agile Construction®. Frischhertz has just added their 19th user and is currently tracking five projects in JPAC®. They have also just begun conducting bi-weekly job review meetings with their entire project team to review the data in JPAC® to make vital improvements to their process of project management and their bottom line!

Frischhertz Electric out of New Orleans has begun their journey toward Agile Construction®. Frischhertz has just added their 19th user and is currently tracking five projects in JPAC®. They have also just begun conducting bi-weekly job review meetings with their entire project team to review the data in JPAC® to make vital improvements to their process of project management and their bottom line!

Aldridge: After seven years of Agile Construction® process and tool implementation, the company’s ownership and executive team led a two-day Strategic Session to communicate why the program started at Aldridge, shared success stories over the past several years, and reiterated its importance in the company’s operations going forward. Alex Aldridge and Mark Carani asked MCA to analyze the company’s reduction in volatility, despite growth and expansion over the past few years. The results showed clear evidence that usage of Agile processes and tools have led to improved profitability and predictability. With full support of the 65 key managers, executives, and field superintendents, the company plans to refocus its education and implementation efforts in 2021 and beyond to use Agile Construction® as a potential Franchising Model.

Aldridge: After seven years of Agile Construction® process and tool implementation, the company’s ownership and executive team led a two-day Strategic Session to communicate why the program started at Aldridge, shared success stories over the past several years, and reiterated its importance in the company’s operations going forward. Alex Aldridge and Mark Carani asked MCA to analyze the company’s reduction in volatility, despite growth and expansion over the past few years. The results showed clear evidence that usage of Agile processes and tools have led to improved profitability and predictability. With full support of the 65 key managers, executives, and field superintendents, the company plans to refocus its education and implementation efforts in 2021 and beyond to use Agile Construction® as a potential Franchising Model. We also wanted to highlight a project that Aldridge completed in 2020, which made use of Agile Construction® processes and tools. Application of Agile on large projects is not new to MCA, Inc. but something that may companies need to learn and adapt to. This project was a success both in its outcome (see here: https://www.ecmag.com/section/your-business/underground-improvement-aldridge-electric-renovates-chicago-subway-stations) and its results for Aldridge.

Lemberg’s leadership team discussed and determined the company’s new strategy and plan for a successful future of the business. An integral part of the company strategy moving forward will be the commitment and dedication to Agile Construction®, which has been recently announced on the company’s website. Project teams are also continuing to practice Agile Construction® across Construction and Data jobs, and have recently engaged and completed a SIS® Next Level training. This training has helped project teams use SIS® for planning ahead, and more accurately capturing obstacles on job sites, allowing stronger feedback to the company that will allow pro-active response to job-site obstacles and improvement of labor productivity on the job site.

Dixie has undoubtedly made major strides in 2020 thanks to the leadership of individuals within and across the company. John Yelverton, President of Dixie, has not only been a driver of progress within his company but in his town as well. Starting 2021, John will share his leadership, passion, and energy with all of Montgomery in his new role as Chairman of the Montgomery Area Chamber of Commerce. Read about his plan, focus, and strategy to develop his hometown and community, and his philosophy to shape a more successful and better Montgomery of tomorrow in the Montgomery Business Journal.

Electric Company of Omaha (ECO) is almost through their 2nd year of the implementation of Agile Construction® on their jobs. Within one and a half years, ECO went from four pilot jobs to 47 jobs in JPAC® in 2020. Electric Company of Omaha focused on implementing the usage of a WBS and JPAC® to all large jobs in 2020, and the results are very positive. Very great results are proven in the reduction of variation of the job results in JPAC® over the last two years. In 2021 there will be a bigger focus on the SIS® usage in the Field as well as the Office. WBS and JPAC® principles will be applied to smaller jobs as well. Design teams have made great progress in designing and implementing several processes throughout this last year and building a training curriculum for the company. ECO’s special attention will continue to be on working with the field to increase prefab usage on all company projects.

No comments:

Post a Comment

Thank you for your comments. Approved comments will post within 24hrs